01 Dec Do I really need an Umbrella policy?

I had a client in my office today asking me how much of an Umbrella policy do I need to buy?

The answer is very simple – What do you need to protect? If you would be sued how much can someone take away?

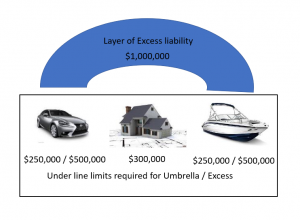

So what is an Umbrella policy? It is primarily extra liability insurance, and it’s designed to help protect you in the event of an accident, a lawsuit or other major claims. It therefore helps to secure your current assets — and your financial future — if you are in a major auto accident, for example, or if someone injures themselves while visiting your home. In general, it is an insurance policy that come as a layer above another insurance policy – there must be some policy or policies that are triggered before the Umbrella policy is triggered. For example, if you have $500,000 on your Auto insurance policy and you are in an accident that the other side sustained injuries of $650,000, where do you get the additional $150,000 of coverage? From your Umbrella policy.

There are two groups of people that it is highly recommended getting an Umbrella coverage:

-

- Net worth, if your net worth is more than than the underlining policy – like on your home insurance of $300,000.

- How exposed are you to risk? do you have a swimming pool? Do you host a lot of people at your home? Do you spend a lot of time on the road? Do you live is a condo with many close neighbors? Do you have a teen at home? These are some examples of higher risk exposures that may want to think about Umbrella protection.

The biggest advantage of an Umbrella policy, besides the extended limits of liability coverage is that it is cheap. Since the underling policy need to pay first, it is like have a very large deductible, this keeps the cost of an Umbrella Policy very low.

I recently learned that homes with solar panels are requited to carry a 1 million dollar liability policy, an Umbrella is the way to go for this protections.

When setting up an Umbrella policy there are minimum limits that you will need to carry on the underlining policies, if you are interested in getting set up, call Marker Insurance at (954) 456-7505, to get a quote.

Please reach out to us to review together your insurance and see if we can help find solution that better fits your needs.

Schedule online

Marker Insurance 954-456-7605

#markerinsurance #insurance#insuranceagent #insurancepolicy#insurancequote#insurancecoverage #insuranceHollywoodFl #autoinsurance #businessinsurance #wcinsurance

Sorry, the comment form is closed at this time.